One of Chris’ favorite Exchanges was a simple forward exchange for a campground owner. This Exchangor sold one large lakefront property and proceeded to use the next 45 days driving up and down the East Coast selecting Replacement Properties. He was in the enviable position of being able to identify more than three Replacement Properties (the simple rule). He used the 200% rule (to identify as many properties as he wanted as long as the total value of the properties identified did not exceed twice the value of the Relinquished Property).

One of Chris’ favorite Exchanges was a simple forward exchange for a campground owner. This Exchangor sold one large lakefront property and proceeded to use the next 45 days driving up and down the East Coast selecting Replacement Properties. He was in the enviable position of being able to identify more than three Replacement Properties (the simple rule). He used the 200% rule (to identify as many properties as he wanted as long as the total value of the properties identified did not exceed twice the value of the Relinquished Property).

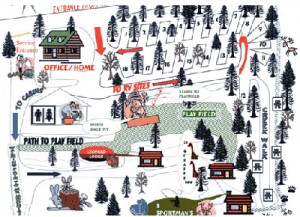

In the end, he acquired eleven new properties from Maine to Florida, many of them single family (rental) residences, including two new campgrounds. This Exchange allowed him to diversify his portfolio, generate significant cash flow from his new properties, and pay no capital gains tax. As they say in the business “one happy camper!” If he determines that one or more of his selections doesn’t satisfy his investment objectives, then after a year or two, he can exchange again.