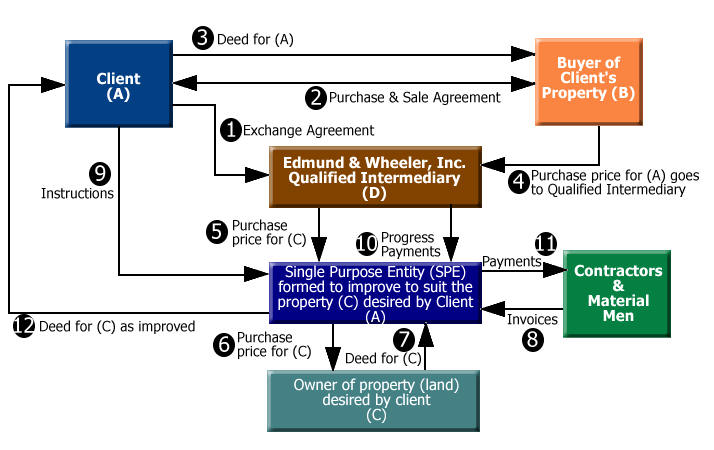

Delayed Build-to-suit Exchange Direct Format

This diagram is for illustrative purposes, some essential steps are not shown

- The Exchange Agreement with Edmund & Wheeler, Inc. which governs the overall transaction. This document MUST be in force before the closing.

- The Purchase and Sale Agreement to sell the Relinquished Property. This step may take place before Step 1 (the only out-of-sequence exception).

- The closing of the Relinquished Property; if several are involved, the first in chronological order. In this step, the deed to the property is given to the Buyer. This step starts the 45-day Identification Period and the 180-day Exchange Period.

- Rather than going to the Exchangor, the Buyer’s funds are used to pay all of Exchangor’s expenses (including mortgages, if any), with the NET going directly to a money center bank into a separate, interest-bearing Qualified Escrow Account established in the Exchangor’s name and Social Security number.

- The Exchangor has identified property C (property needing improvements) as the Replacement Property; at this Step, Edmund & Wheeler, Inc. causes the necessary purchase price for this property to be advanced to the Single Purpose Entity (which IRS has renamed an Exchange Accommodation Titleholder (EAT)) which has been formed to own and improve the identified Replacement Property.

- This is the closing for Property C; this Step is the funding; and

- This Step is the legal acquisition. At (or hopefully well before) this time, Exchangor engages Contractors and Materialmen to effectuate the desired improvements

- These vendors begin work, and soon enough, bills begin to arrive, addressed to the EAT, the legal owner of the property.

- All invoices are presented to the Exchangor for approval for payment from the Account.

- Upon such approval, further advances are made by the QI to the EAT to cover each payment.

- The vendors are timely paid, until funds are exhausted.

- This is the Exchangor’s receipt of the direct deed from the EAT as owner of the Replacement Property; provided the deed is delivered to the Exchangor on or before the 180th day (as adjusted), the Exchangor achieves a Section 1031 Exchange between Steps 3 and 12, where at Step 3 a deed is given and at Step 12 a deed is received, and in between the Exchangor had no control (or Constructive Receipt) of funds.