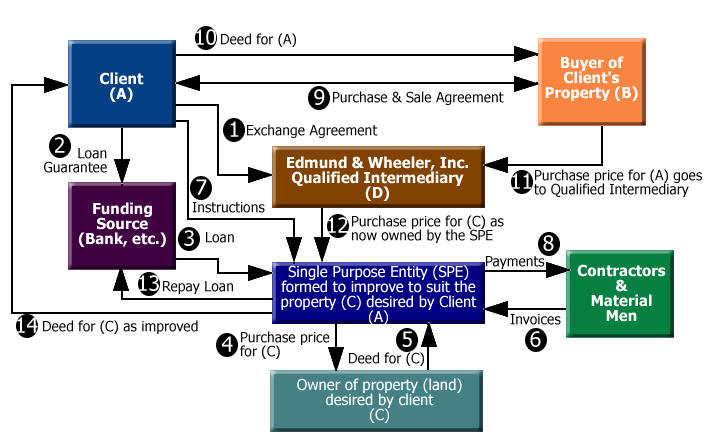

Delayed/Simultaneous Build-to-suit Exchange Reverse Format (Exchange Last)

This diagram is for illustrative purposes, some essential steps are not shown

- The Exchange Agreement with Edmund & Wheeler, Inc. which governs the overall transaction. This document MUST be in force before the closing.

- Since the Replacement Property will be purchased (and Parked) before the sale of the Relinquished Property, a source of funds for the purchase must be arranged. This can be the Exchangor, or their bank. If a bank, the Exchangor will be expected to provide a guarantee.

- This is the loan (and Line of Credit) to the Single Purpose Entity (which the IRS has renamed an Exchange Accommodation Titleholder (EAT)) that will buy the Replacement Property from its owner (C) and improve it and hold it until the Relinquished Property (A) can be sold to the Buyer (B).

- This is the actual purchase of the Replacement Property from its owner (C) by the EAT.

- At this step, the EAT (and not the Exchangor) becomes the legal owner of the Relinquished Property. The 180-day Exchange Period commences. At (or hopefully well before) this time, Exchangor engages Contractors and Materialmen to effectuate the desired improvements.

- These vendors begin work, and soon enough, bills begin to arrive, addressed to the EAT, the legal owner of the property.

- All invoices are presented to the Exchangor for approval for payment from the Line of Credit.

- The vendors are timely paid, until the predetermined match point has been obtained.

- The Relinquished Property (A) goes under Agreement

- The Exchangor gives Buyer (B) a deed, and the transaction closes; this step must occur before the 180th day, with enough margin to complete Steps 11-14.

- Rather than going to the Exchangor, the Buyer’s funds are used to pay all of Exchangor’s expenses (including mortgages, if any), with the NET going directly to a money center bank into a separate Qualified Escrow Account established in the Exchangor’s name and Social Security number.

- As Edmund & Wheeler, Inc. is the signer on the Qualified Escrow Account, it causes the balance to be paid to the EAT in exchange for its deed for the Replacement Property executed in favor of the Exchangor.

- Before the deed can be issued, however, the EAT must pay off (or pay down to the extent of available cash) the loan made to it at Step 3, above.

- This is the Exchangor’s receipt of the direct deed from the EAT as owner of the Replacement Property; provided the deed is delivered to the Exchangor on or before the 180th day, the Exchangor achieves a Section 1031 Exchange between Steps 10 and 14, where at Step 10 a deed is given and at Step 14 a deed is received, and in between the Exchangor had no control (or Constructive Receipt) of funds.