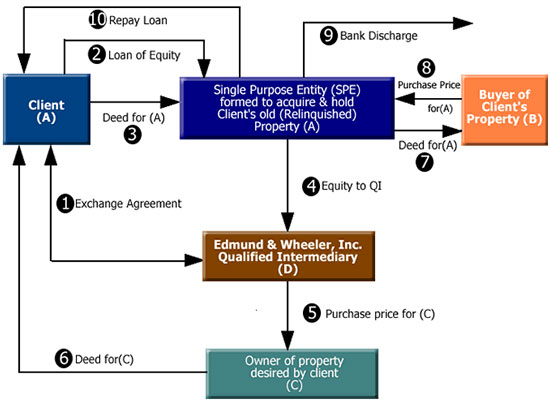

Delayed Exchange (Existing Property) Reverse Format (Exchange first)

This diagram is for illustrative purposes, some essential steps are not shown

- The Exchange Agreement with Edmund & Wheeler, Inc. which governs the overall transaction. This document MUST be in force before the closing.

- In consultation with the QI, the Exchangor determines what the NET proceeds would have been had the Relinquished Property sold that day; this is the cash amount of a loan to be made by the Exchangor to the Special Purpose Entity (Exchange Accommodation Titleholder (EAT)) that will buy the Relinquished Property from the Exchangor (A) and hold it until this property can be sold to the Buyer (B).

- In this Step, the Exchangor executes a deed to the Relinquished Property to the EAT. Not shown is a mortgage back to the Exchangor to provide for security. The 180-day Exchange period commences.

- The exact amount of the loan funds in Step 2 are turned over to Edmund & Wheeler, Inc. as QI.

- Since the Exchangor has identified Property C as the Replacement Property, the QI is instructed to fund its purchase.

- This is the Exchangor’s receipt of the direct deed from the owner of the Replacement Property (C); the deed is delivered to the Exchangor almost immediately after the Steps above; the Exchangor achieves a Section 1031 Exchange between Steps 3 and 6, where in Step 3 a deed is given and in Step 6 a deed is received, and in between the Exchangor had no control (or Constructive Receipt) of funds.

- Exchangor’s former property (the Relinquished Property) is now legally owned by the EAT, however, the Exchangor is expected to continue the marketing effort and to approve all offers. When Buyer (B) is found, the EAT executes a deed to the Exchangor’s Relinquished Property in favor of this person.

- The Buyer (B) pays the purchase price to the EAT, which uses the funds to:

- Payoff the bank (if any); and

- To repay the initial loan from the Exchangor.