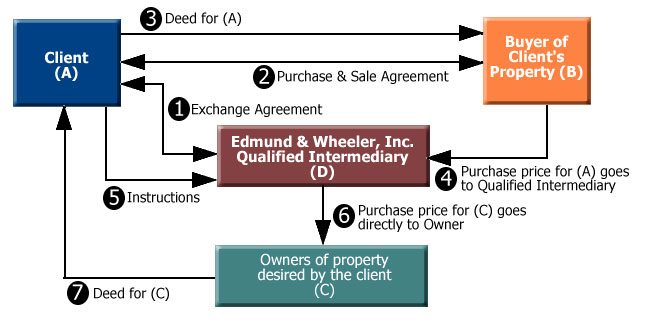

Delayed Exchange (Existing Property) Direct Format

This diagram is for illustrative purposes, some essential steps are not shown.

- The Exchange Agreement with Edmund & Wheeler, Inc. which governs the overall transaction. This document MUST be in force before the closing.

- The Purchase and Sale Agreement to sell the Relinquished Property. This step may take place before Step 1 (the only out-of-sequence exception).The closing of the Relinquished Property; if several are involved, the first in chronological order. In this step, the deed to the property is given to the Buyer.

- The closing of the Relinquished Property; if several are involved, the first in chronological order. In this step, the deed to the property is given to the Buyer.

- Rather than going to the Exchangor, the Buyer’s funds are used to pay all of Exchangor’s expenses (including mortgages, if any), with the NET going directly to a money center bank into a separate, interest-bearing account established in the Exchangor’s name and Social Security number.

- This is an interactive step encompassing all communications post-closing with the Exchangor and Edmund & Wheeler, Inc. Included are the 45-day Identification Letter, instructions on how much of the account to be expended on particular properties, and final approval to close on the final choice(s).

- These are the precise instructions to Exchangor’s attorney, bank or Title Company for the closing of the Replacement Property, and the wire transfer of approved funding.

- This is the Exchangor’s receipt of the direct deed from the owner of the Replacement Property (C); the Exchangor achieves a Section 1031 Exchange between Steps 3 and 7, where in Step 3 a deed is given and in Step 7 a deed is received, and in between the Exchangor had no control (or Constructive Receipt) of funds.