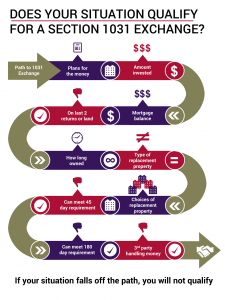

- Plans for the money – The greatest benefit from capital gains deferral will be obtained by reinvesting all of the cash from the sale of your property. It is possible to extract cash at closing; however, the amount you take will be subject to tax.

- Amount invested – How did you acquire the property and how long have you owned it? Did you purchase it, exchange into it? Was it given to you or did you inherit it? The answers to these and other questions will determine whether you have a low or high cost basis and what your exposure is to Capital Gains Taxes. If the tax to be paid is greater than $5,000, an exchange should be considered.

- Mortgage balance – The outstanding mortgage debt is paid off at closing in the same manner as any other closing; and debt paid off must be replaced when the new property is acquired or new cash added to offset any difference. Any debt relief not offset by new cash will result in taxable boot.

- On last two tax returns or vacant land – Your tax return provides the IRS with an audit trail of your past activity. Your rental property must have appeared on Schedule “E” of your return (or the corporate equivalent) if you want to portray your property as held for investment or for use in your Trade or Business. The only exception will be vacant land.

- How long owned – Dealers are not permitted to use Section 1031. Generally their assets are “held for sale” not “held for investment”. In order for a property to be considered for long-term capital gain treatment, it must have been owned by you for at least one year.

- Type of replacement property – Section 1031 requires that the property be “like-kind”; all real property is like-kind to all other real property. The Like-kind test is more stringent for personal property.

- Choices of replacement property – Under the simple rules, you may select up to three potential new properties and you can buy any one, two or all three of them. More choices are available; however the dollar value of the choices is capped at 200% of the value of the old property.

- Can meet 45 day requirement – After the closing of the old or Relinquished Property, you will have 45 days to make your formal identification of Replacement Property choices. No substitutions are permitted after the 45th day.

- Can meet 180 day requirement – After the closing of the old or Relinquished Property, you will have 180 days to acquire the new or Replacement Property. Exchanges must be accounted for within the same tax year. Often it is necessary to extend the due date of the tax return to accomplish this task and to get the full benefit of 180 days for a year-end exchange.

- Third party handling of money – Receipt of funds by the taxpayer at closing is not permitted in a Section 1031 Exchange. A Qualified Intermediary must be designated to facilitate this process so that the taxpayer never has constructive receipt of the funds. Relatives and attorneys or accountants that have represented the taxpayer in the last two years are prohibited from acting as the Qualified Intermediary.

Have qualification questions?

We have provided flawless Section 1031 exchanges for over 30 years. Exchanges are our only business.

Contact us if you have any questions regarding your specific situation.