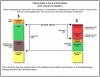

We have conditioned our clients to expect that state capital gains tax can be deferred along with the federal tax exposure by utilizing Section 1031 for their exchanges. It is true, most states will honor the deferral as long as the gain is being rolled into the new property. However, you should be aware that […]