At first glance, one might be tempted to say that Section 1031 is an overly generous provision of the tax code whose time has passed. But wait: Section 1031 was first passed into law on March 8, 1921, in the waning days of the Wilson Administration, and has been reviewed and commented upon in nearly […]

Tag Archives | Section 1031

Structured Sales – A Solution for a Failed Exchange

While this technique is not for everyone, rather than face the taxes due when an exchange fails, this may be an option that will provide tax relief. The disappointment of a failed exchange (one where the identification fails or the replacement property is undesirable) is exasperated by the tax consequences of having to pay the […]

NH DRA Gives Refunds – TIR 2010-009

By John D. Hamrick Please TIR 2010-009 outlining the ability for a taxpayer who got snared in the New Hampshire DRA audit of Section 1031 exchanges to get there money refunded! How sweet it is!

Splitting Heirs

The transfer of wealth from one generation to another will hit its peak in just a few years and understanding the tax impact on the heirs is an important consideration.

Risk & Reward – Stock Vs. Real Estate

In a perfect world your investment portfolio would contain a combination of Real Estate, Stocks, Bonds, Mutual Funds and Cash providing both long-term and short-term instruments. Diversification of your assets is key to riding out the peaks and valleys of investment performance. In today’s changing economic environment, understanding your exposure to risk will ultimately define […]

What’s In a Name?

If you are conducting a Section 1031 Exchange, “what’s in a name” can be the difference between a successful exchange and one that will fail on its face. This provision, called the Identity of Taxpayer Rule, requires that the same person or entity that sold the old or Relinquished Property be the same one that […]

Selling Your Second Home without Paying Capital Gains Tax Takes Planning

It is possible to convert property from one type to another without tax consequences. Your primary residence can become your rental/investment property and your investment/rental property can become your primary residence.

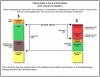

Visualizing a Section 1031 Exchange

We find that many times the concepts of basis, indicated gain, realized gain and most importantly the level of taxation that is faced when selling investment property is widely mis-understoon. Even amongst professionals. We have developed a quick and easy tool to help to visualize a Section 1031 Exchange.

New Section 121 Rules Begin to Bite

By: George E. Foss III As the days and weeks pass, the effectiveness (from IRS’ perspective) of the new provisions slipped into Section 121 grow and grow. It used to be true that you could move into one of your rental properties, live there for two more years as your primary residence, and then sell […]

Straight Talk About Section 1031 and Protecting Your Exchange Funds

It’s tough out there right now. To make matters worse, in the past year hundreds of taxpayers who trusted their money, sometimes their life savings, to Qualified Intermediaries to take advantage of Section 1031, lost it all. A good Qualified Intermediary will have safeguards and policies in place to ensure your Exchange funds are there […]